内付中文 £25K/£35K 投资视频介绍

↓ ↓ ↓ 请往下滚动到金鸡蛋视频介绍 ↓ ↓ ↓

Dear everyone,

My name is Ronnie Gleeson. I am a director of Thames Property Management and Thames Property Nest eggs. It’s my Pleasure to meet you all.

Best Bespoke London Estate Agent 2015 (Current)

Best Estate Agent Services to Landlords and Tenants (Joint Award) 2015 (Current)

Mr Ronnie 他是泰晤士物业管理的业务总监,他有着非常丰富的房产管理经验,他自己的65套房子也是他亲自管理。他在2012年加入了UKALA并跟伦敦的房东说: I am not trying to change the world, as I was with residential child care and special education. My aim has been to build the business gradually, providing a quality lettings business essentially with a landlord’'s hat on, with no ridiculous over-the-top charges, that is fair to both landlords and to tenants.

Thames Property Management 10% Full Management

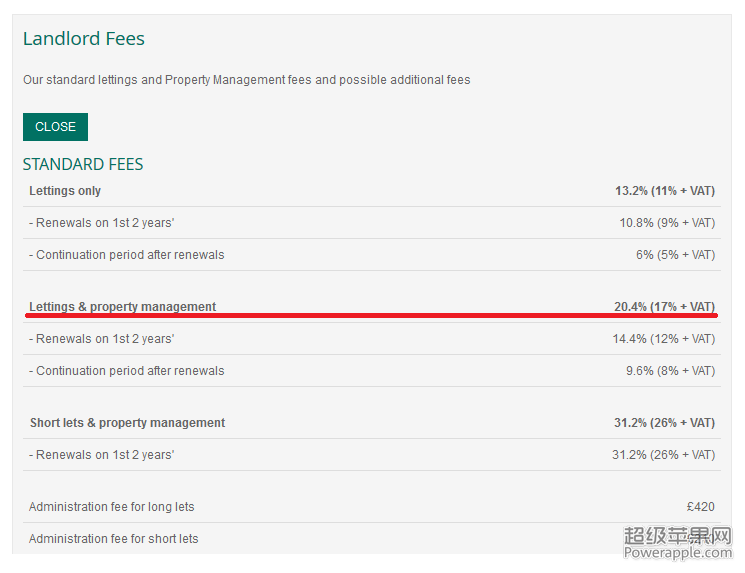

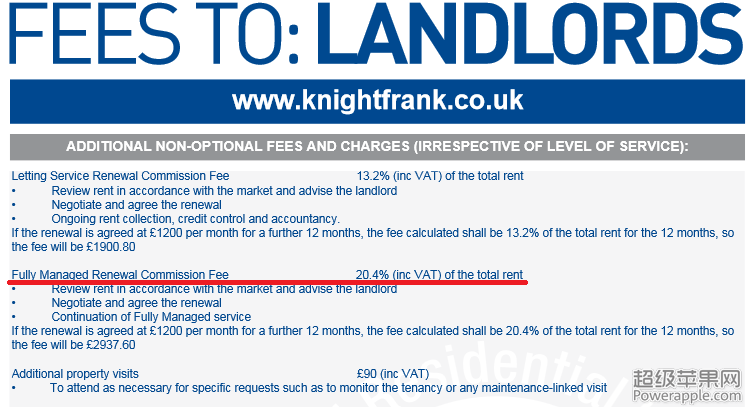

伦敦其他中介的收费:

Foxton Landlord Charges Example:

Knight Frank Charges Example:

[b]如果你也有意向把房子交给我们Thames Property管理/出租,并同时希望拥有你可能从来都没有遇到过的待遇/服务,请立即跟我们联系,让我们来实现你的梦想!

↓ ↓ ↓ 请往下滚动到金鸡蛋视频介绍 ↓ ↓ ↓

欢迎联系我们:

微信:WPDLTD

电话:07562 598989 (中文 or English)

邮箱:[email protected]

网站:http://thamespropertymanagement.com/

网站:http://thamespropertynesteggs.com/

地址:Thames Property Management

78 York Street

London

W1H 1DP[/b]

----------------------------------------分隔线----------------------------------------

以下是UKALA关于他的文章:

↓ ↓ ↓ 请往下滚动到金鸡蛋视频介绍 ↓ ↓ ↓

----------------------------------------分隔线----------------------------------------

英文视频介绍:

https://www.youtube.com/v/rvfvkK3AS8E&autoplay=1

中文视频介绍:

https://www.youtube.com/v/bbWyWyGEdTo&autoplay=1

[b]

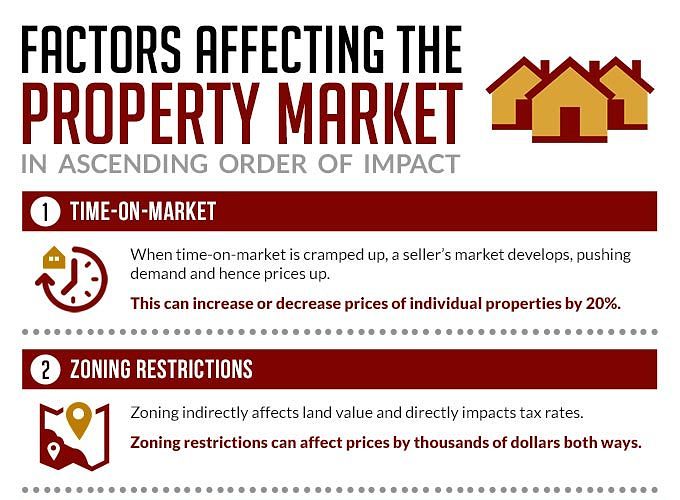

Thames Property Nest Eggs是一个传统而成熟的投资模式。它具有高稳定性,针对性和操控性。投资者完全参与每一项目的竞投,可以决择自己喜欢的房产项目。这是一个让投资者合作投资伦敦房地产的项目,并且能为他们提供最佳的机会和最最优质的服务平台。

1)每一个金鸡单的项目里,投资者可以拥有百份之百的股权也可以只拥有十份之一的股权。

2)为了确保我们理想的利润,我们金鸡蛋的项目里购买的房子价格都会比市场价至少低于百份之十。

3)为了尽可能的保证每一个投资项目都具有更大的升值空间。 我们会将房产投资区域集中于人流量较大的地段。比如像M25公路,毗邻地铁站或火车站的地段。

4)我们拥有自己的建筑团队,所以省下了不必的第三方费用。

全新堆出:除了Thames Property Nest Eggs(Plan A / 5年),我们还有合适短线投资的,Tames Property Nest Eggs(Plan B / Fast Track)。

如果你也有意向投资伦敦房地产,并同时希望拥有百分之百的房产控制权,请立即跟我们联系,让我们来实现你的梦想!

欢迎联系我们:

微信:WPDLTD

电话:07562 598989(中文 or English)

邮箱:[email protected]

网站:http://thamespropertynesteggs.com/

网站:http://thamespropertymanagement.com/

地址:Thames Property Management

78 York Street

London

W1H 1DP

↓ ↓ ↓ 请往下滚动到我们更详细的信息 ↓ ↓ ↓

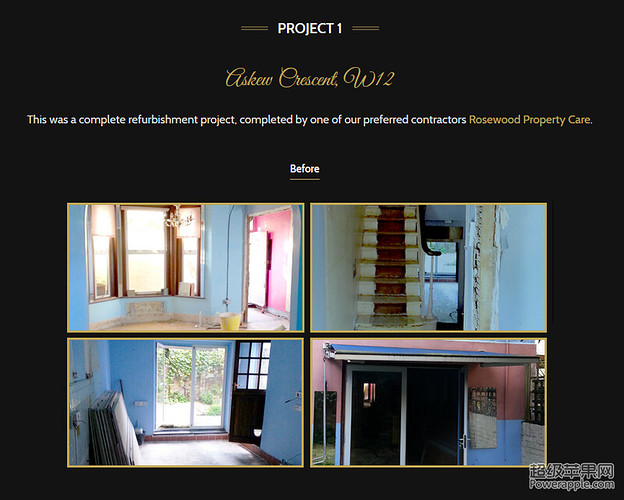

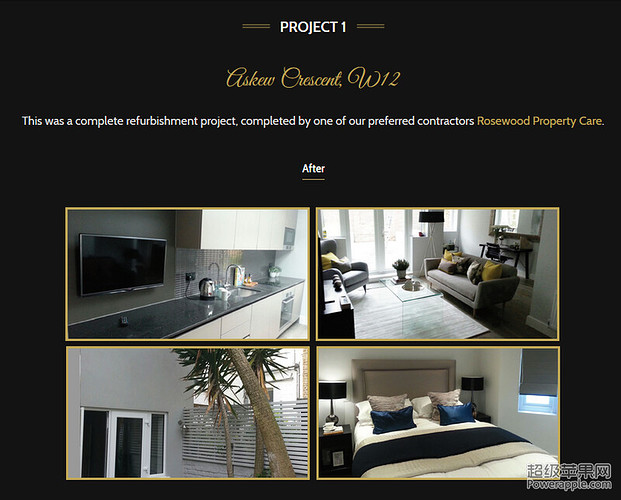

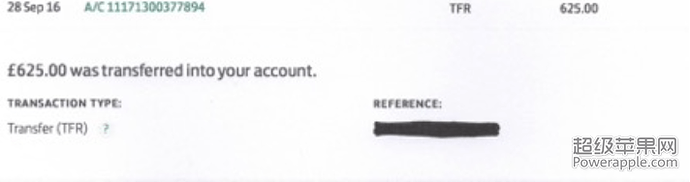

最近完成的金鸡蛋项目(一):

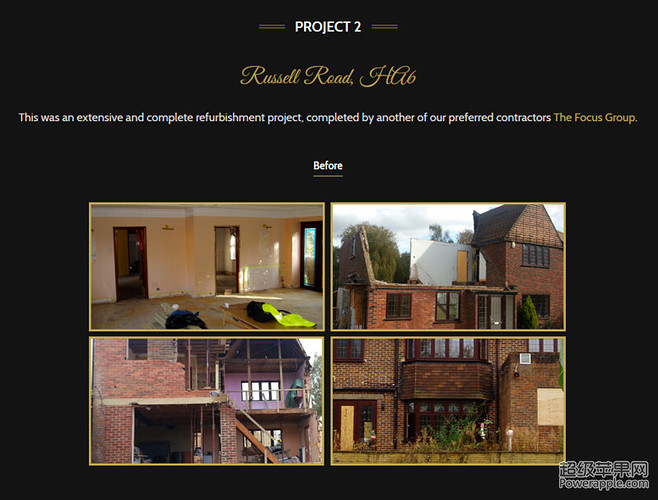

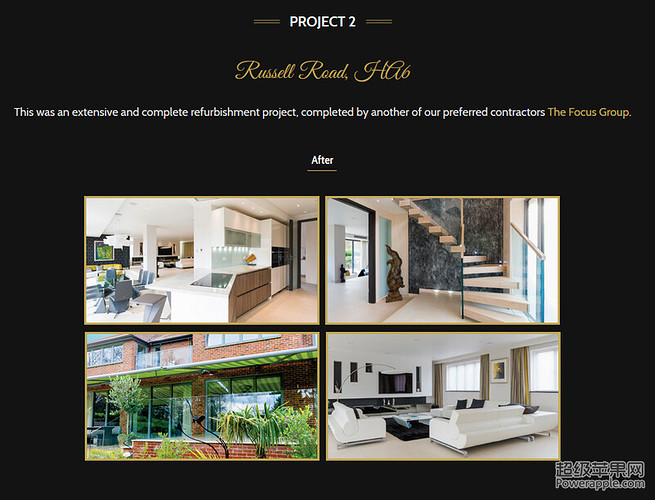

最近完成的金鸡蛋项目(二):

最近加入我们的投资者:

Thank you for your support Doctor Smith! Trust me this is the best financial investment you’ve ever made.

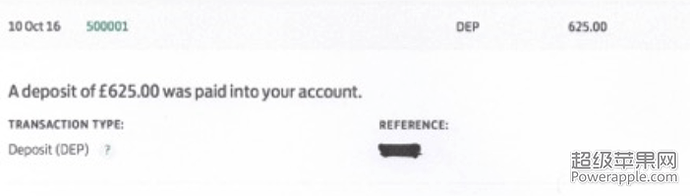

陈先生,你的Application Fee我们已经收到了,谢谢你允许我们把收据作为广告介绍。在房子改造开始后,我们会定期给你发房子改造报告。

王先生,感谢你对我们公司的信任,加入了我们2017年一月的房子项目,我们会定期给你房子改造报告发到你的邮箱。谢谢

欢迎联系我们:

微信:WPDLTD

电话:07562 598989 (中文 or English)

邮箱:[email protected]

网站:http://thamespropertymanagement.com/

网站:http://thamespropertynesteggs.com/

地址:Thames Property Management

78 York Street

London

W1H 1DP[/b]

↓ ↓ ↓ 请往下滚动到我们更详细的信息 ↓ ↓ ↓

↓ ↓ ↓ 请往下滚动到我们更详细的信息 ↓ ↓ ↓