只要就业率不降,必须得买呀

建房成本摆在那里,中部还能咋降。最多横盘。

横盘的话,放租区的优势不就出来了,所以火啊

2009年的时候和2013的时候比较,经济前景就业率差别不大,但2009年没人敢买,2013都在抢。所以我敢肯定下次再大跌还是没人敢买,人性的共同点,大跌的时候大家怕的是还会进一步跌,涨的时候大家想的是还会进一步涨。 {:5_142:}

成本价格理论还是不如边缘价格理论有效。 {:5_137:}

Sovereign wealth funds and central banks may look to cut their U.K. assets in 2017 after sentiment toward the country slumped since Britain voted to leave the European Union, according to an Invesco Ltd. report.

About 41 percent of institutions, who together oversee about $12 trillion in assets, said they expect to introduce new underweight positions in the U.K. this year, a survey published on Monday showed. Britain was also deemed to be the least attractive developed market, scoring 5.5 out of 10 in 2017, the report said. That’s down from 7.5 in 2016.

“It’s a very sharp movement for what was one of the most attractively rated markets,” Alex Millar, Invesco’s head of sovereigns in Europe, the Middle East and Africa, said by phone. “When you wake up one morning and your investment is worth 20 percent less than the previous day, that’s going to have an impact,” he said, referring to the pound’s depreciation as a result of the Brexit vote.

The most important market news of the day.

Get our markets daily newsletter.

The survey, which interviewed 97 institutions from January through March, found that investors were starting to question the future of Britain as an “investment hub” in Europe. This comes after Prime Minister Theresa May pledged that she would seek a good deal for London’s financial-services industry when she negotiates the country’s withdrawal from the EU. She first has to win this month’s general election.

Uncertainty around what sort of trading deal the U.K. will manage to hash out with Brussels is forcing many investors to take a “wait-and-see” approach, according to Millar. Some 54 percent said they aren’t making any changes to their allocations until they can assess the longer-term impact of Brexit, the survey shows.

Elsewhere, the U.S. was considered by investors to be the most attractive market to invest in, scoring 8 out of 10. Germany ranked first in Europe with a score of 7.8 and Italy and France were rated 6.1. Japan scored 6.6 and India was 6.1.

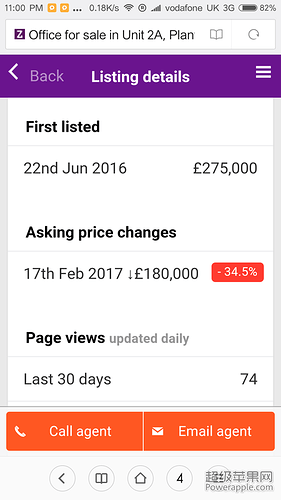

好像真有点降了, 好几个以前观望的朋友都给了offer因为是reduced. 觉得市场不是很乐观。

看不懂市场。 减价的到处都是,卖掉的asking price 的也很多。 标价合理,地段房型都好,还是卖的很快。

这两年由于工作原因去了一些发展中国家,比如巴西,土耳其,卡萨克斯坦,泰国,墨西哥。我基本上到了当地都问房价。房价和普通老百姓收入其实没啥关系,很多发展中国家三线城市的房子也至少是他们的upper middle class才能负担的起。现代化的进程已经超高速的抛弃一些普通老百姓对幸福生活的期待了。巴西这种经济都快崩溃的国家,三线城市的110平米阿partment要20万英镑,当然条件比较好一点,比较新,那房屋中介旁边的服装店,40英镑的T恤可以分期付款,让人觉得不可思议。伊斯坦布尔half million pounds apartment到处都是。问当地的中产他们根本不知道价格,因为这些跟他们的生活没有关系。个人观察的是老百姓收入和房价涨跌的相关性真不强。

我是抛砖引玉, 想听听这里牛人的看法。

网上看Kingston 过去6个月售价跌了4%,伦敦N2,N6一类的都没变化

今年要价比去年高10-20%,要找要砍要认准

你这是什么软件

bloomberg 啊

朋友刚刚买卖完N2。自住房。减10%卖掉自己的,砍了10%买进。好像原来的60多,现在的70多万。

我觉得要看房价,尤其在伦敦,超过50万的,很难卖出去。70-80万,上100万的,基本上卖不出去。但30万以下的还很抢手。

不同地方有不同的price sweet point{:5_137:}

种菜达人现在也不好好种菜了,整天关注这个房市,英国一个烂摊子,没啥涨头了

种菜也不长,尽长草了。 {:5_139:}

跟着感觉走

如果退欧了,房价真的会降?