在地铁站一公里内买one bed flat贷款需要多少年收入?这张地铁图有答案。

https://www.totallymoney.com/assets/images/mortgages/totallymoney-tube-salary-infographic.pdf

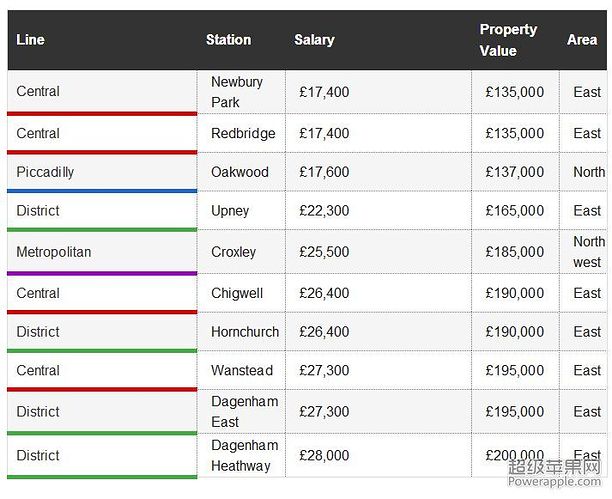

最便宜十个地铁站

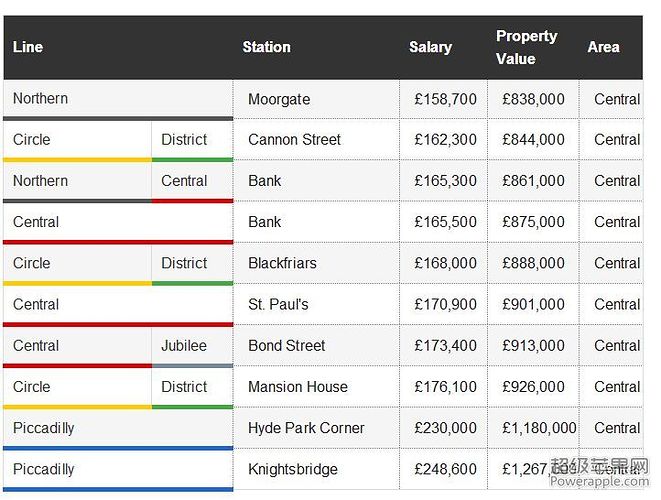

最贵十个地铁站

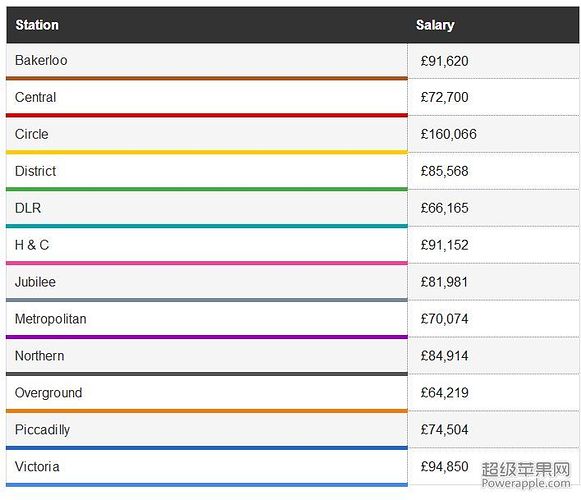

地铁线平均房价

Buying in London? Here’s what you need to earn

https://www.totallymoney.com/mortgages/how-much-salary-buy-london/

We’ve created a map to show how much you need to earn to get a mortgage on a home across London Underground, Overground, and DLR stations. To no one’s surprise, a lot of places are out of reach for many. But, there may be a small glimmer of hope for those determined to buy in London.

It’s not unusual for people to move outside London to find affordable homes. For many, finding the perfect commuter hotspot is essential for getting on the property ladder — and, in some cases, their only viable option.

The ardent city dwellers among you, though, might balk at the thought of leaving the capital, desperate to make London your forever home. But, how realistic is it to spend the rest of your days in the Big Smoke?

The numbers bit

We’ve been crunching a lot of numbers behind the scenes to give you the figures on our Tube map. So, how did we work it out?

We took the median house price of one-bedroom properties currently available within one kilometre of each station, and assumed a deposit of 10%. Then, we worked out the monthly repayment on the mortgage you’d need over 25 years. Of your total net earnings, 40% would go on the mortgage repayment. This is because tenants in London spend nearly 49% of their income on rent.

We then worked backwards to calculate how much tax and national insurance you’d pay — considering all tax bands — to arrive at the gross salary you’d need to afford a mortgage on a property in that area.

Simple, right?

The 10 least-expensive stations

If you’re determined to buy in London, you need to head east for the most affordable areas: eight out of the 10 cheapest places are in east London, with stations on either the District or Central line.

Redbridge and Newbury Park take joint first place. Here, you need a salary of £17,400 to get on the property ladder, and since the average UK wage is £22,400, these locations are certainly an attainable option for many. The median price of a one-bedroom flat here is £135,000.

If east London doesn’t take your fancy, your only other options are one location in north London, and one location in north west London: Oakwood on the Piccadilly line, which takes third place, and Croxley on the Metropolitan line, which takes fifth.

The median house prices here are £137,000 and £185,000 respectively, and need salaries of £17,600 and £25,500.

Line Station Salary Property Value Area

Central Newbury Park £17,400 £135,000 East

Central Redbridge £17,400 £135,000 East

Piccadilly Oakwood £17,600 £137,000 North

District Upney £22,300 £165,000 East

Metropolitan Croxley £25,500 £185,000 North west

Central Chigwell £26,400 £190,000 East

District Hornchurch £26,400 £190,000 East

Central Wanstead £27,300 £195,000 East

District Dagenham East £27,300 £195,000 East

District Dagenham Heathway £28,000 £200,000 East

Keep in mind that although the two cheapest areas have direct links to central London, residents of Redbridge and Newbury Park still have to travel for approximately 29 and 34 minutes on the Central Line to get there.

If your heart isn’t truly set on buying in London, you might benefit elsewhere. For example, Waltham Cross, Cheshunt, and Gravesend — all locations outside of the capital — have shorter journey times into central London.

The 10 most-expensive stations

No prizes if you guessed correctly that Knightsbridge on the Piccadilly line takes the top spot for most-expensive station. It lives in the Royal Borough of Kensington and Chelsea, which is one of the most affluent areas in London. To get a mortgage for a property here you need to be earning £248,600.

Following close behind is Hyde Park Corner, another Piccadilly line station, which lives in the City of Westminster. That’s the same borough as Buckingham Palace, the Houses of Parliament, and 10 Downing Street. You’ll need an annual income of £230,000 if you fancy being neighbours with the Queen and the Prime Minister.

For perspective, the Prime Minister earns approximately £150,000, meaning the leader of the United Kingdom would be priced out of living at Hyde Park Corner. In fact, the Prime Minister would be priced out of living near all of the 10 most-expensive stations. See the full list below.

Line Station Salary Property Value Area

Northern Moorgate £158,700 £838,000 Central

Circle District Cannon Street £162,300 £844,000 Central

Northern Central Bank £165,300 £861,000 Central

Central Bank £165,500 £875,000 Central

Circle District Blackfriars £168,000 £888,000 Central

Central St. Paul’s £170,900 £901,000 Central

Central Jubilee Bond Street £173,400 £913,000 Central

Circle District Mansion House £176,100 £926,000 Central

Piccadilly Hyde Park Corner £230,000 £1,180,000 Central

Piccadilly Knightsbridge £248,600 £1,267,000 Central

Average on each line

Even though there are some stations where buying a home is affordable, this is largely due to their distance from central London. Yes, that means you won’t be living somewhere with Westfield, The Shard, or Trafalgar Square on your doorstep.

The truth is, for most of the stations, you’d need a salary way above the national average to make them affordable. Many would be priced out on averages alone.

Recent data from HMRC says those with incomes over £70,000 are among the top 5% of earners. For 10 out of the 12 lines, then, you’d need to be in the top 5% to afford a home in one of these areas. See the average for each line below.

Station Salary

Bakerloo £91,620

Central £72,700

Circle £160,066

District £85,568

DLR £66,165

H & C £91,152

Jubilee £81,981

Metropolitan £70,074

Northern £84,914

Overground £64,219

Piccadilly £74,504

Victoria £94,850

So, who can afford to buy in London, then?

It’s no secret: some jobs pay better than others. So, we’ve looked at average London salaries for an array of different industries, to see what professions give buyers the most choice when it comes to finding a London home.

Nurses make just over £28,000, meaning they can only afford to live near 2% of all London Underground, Overground, and DLR stations.

Teachers earn £30,000, and would benefit most from teaching in east London. Eight out of 10 affordable locations are based there: Newbury Park, Redbridge, Upney, Chigwell, Hornchurch, Wanstead, Dagenham East, and Dagenham Heathway.

Firefighters earn nearly £31,000. They have the same options as teachers, with the added option of Becontree.

Bus Drivers earn almost £25,000. They would need to drive all the way to Upney, Oakwood, Redbridge, or Newbury Park to afford a London home.

Journalists earn about £41,500, which means they can afford to live near 15% of all London stations.

Marketing Managers make £45,000, which could get them a mortgage on a property near 22% of all stations.

Sales Assistants earn just over £16,000, pricing them out of buying a home in London entirely.

CEOs earn close to £134,000. This means they can afford the average mortgage across all stations — except for Circle line. They can afford to live by 84% of all London stations.

Chefs earn just over £20,000 — a couple of thousand shy of the average UK salary. This limits their buying potential in London to Redbridge or Newbury Park stations. Otherwise, they could spend their dough on a place in Oakwood, the penultimate stop on the Piccadilly line.

Front-End Developers earn just over £40,000, which means they can afford to live near 10% of all London Underground, Overground, and DLR stations. But, their jobs are likely to be based around Old Street, owing to its prominence of technology companies. Old Street is based on the Northern line, and only two affordable stations (Morden and High Barnet) have direct connections there.