谢谢!还是中文好沟通。

我跟你说我为什么confused:

我查的:

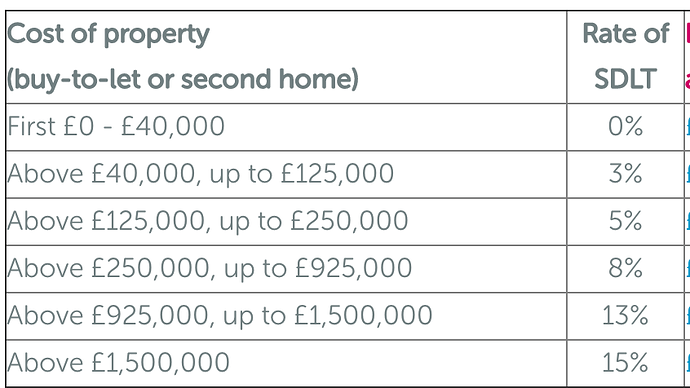

The higher rate is 3% above the standard rates of SDLT.

这里我理解的higher rate=standard rate+3%,就是3%,5%,8%等等。

然后关于申请退印花税这里官方说法是:

You can apply for a repayment of the higher rates of SDLT for additional properties

这个意思看起来就是可以申请higher rate的印花税,就是上面说的3%, 5%,8%对吧,所以我就理解成了所有交的印花税都可以申请回来,就是前面的例子的3万镑了。。。

你的说法我明白,另外一个网页说法比我上面给你的官方说法其实更好,跟你说的就一致了:

you can sometimes claim back the Stamp Duty surcharge.—这里用的是surcharge。

If you purchased a new main residence without selling your previous one, you would have effectively purchased a second home. Therefore, you would have likely paid second home Stamp Duty - i.e. Stamp Duty at the basic rate plus the 3% surcharge.

If you then sold your old property within 3 years of purchasing your new one, you may be entitled to a refund on the surcharge.

所以上面说的surcharge就能让人更明白能申请退回的就是surcharge 3%了。

而不应该用higher rate,因为higher rate =standard rate+3% surcharge。

你明白我为什么confused了吧。

谢谢!